A new white paper from Cisco provides a good review on mobile monetization opportunities for mobile operators, by using intelligent infrastructure to offer policy-based tiered and value-added services. None of the ideas is new, but it seems that the market is ready now to implement such solutions - keeping in mind that some of the ideas are threatened by Net Neutrality (e.g. QoS) or privacy concerns (e.g. ad insertion).

See "Monetizing the Mobile Internet" - here (pdf)

"To raise ARPU beyond basic subscription revenue, mobile operators now have an opportunity to differentiate themselves from over-the-top providers and other third-party vendors by deploying intelligent, IP-based network solutions. .. Such real-time session- and subscriber-state intelligence is not available through the cookies in a web browser interaction but only through the intelligent capabilities of the operator’s mobile Internet core. This intelligence includes correlation of subscriber subscription plans and preferences with awareness of time of day, location, usage pattern, type of application running, available bandwidth, roaming status, and other factors to enable features such as:

- Service-aware charging

- Access control

- Policy control

- Content filtering

- Quality of service (QoS)

- Application detection and control

- Filtering, caching, and ad-insertion

- Security

Source: Network Strategy Partners, LLC, 2010

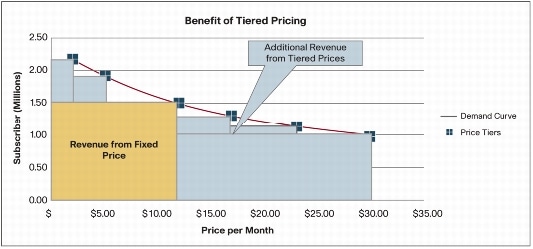

"The figure shows that as prices increase, the number of subscribers declines. In this example, a single flat-rate plan of US$12 per month attracts 1.5 million subscribers and produces revenue of $18 million per month. However, the demand curve shows that many subscribers are willing to pay more for a higher-tier service. This is premium revenue that can be captured through premium pricing plans. Additionally, the demand curve also shows that some additional subscribers would subscribe to a service if it were priced below $12 per month. The study found that the introduction of service tiers added $22.9 million per month in additional revenue and a net increase in total subscribers from 1.5 million to 2.2 million with an ARPU increase of $6.85 per month."

See recent examples from Telkomsel and Elisa

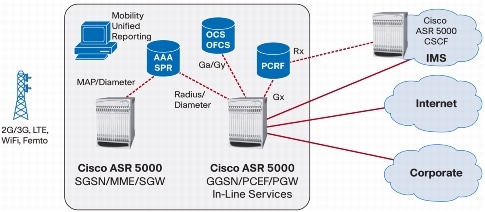

And so they explain all other monetization opportunities. Of course , Cisco emprises the need for "intelligent mobile Internet infrastructure" and DPI to do that, referring to Cisco's ASR-5000 (See also "DPI Announcements - Cisco/Starent PGW - DPI, QoS, LI" - here), the GGSN product of former Starent and the use of a PCRF (See - "Cisco Needs a Policy Server" - here) for policy management.

No comments:

Post a Comment