.jpg)

During the years I write this blog I had a number of posts speculating that certain announcements made by

Openet refer to

AT&T ("

Openet Sees PCC for VoLTE Success (AT&T?)" -

here; "

[Rumors]: AT&T "Sponsored Data" is Based on Openet's PCC" -

here; "

Openet - Why AT&T Changed its IPad Service plans?" -

here),

However, I could not get a confirmation from Openet (not even off-the-record!) that this was the case. Recently, Openet made it public information, by including AT&T in its

customer page and providing the case study (

here) - "

Openet supplied Evolved Charging, Balance Manager, Mediation, and Policy Manager to this leading operator".

"in 2002 Openet supplied their mediation product to AT&T to collect voice and data calls from AT&T’s 2G network. This was followed up with the supply of Openet’s Policy Manager product and their On-line Charging System product in 2008 and 2009 respectively to cater for the advance in 3G mobile data. As AT&T launched new 4G networks and new services Openet’s products have grown to support the new and innovative use cases that AT&T need to supply to maintain and grow their market position and enhance their reputation as one of the most innovative mobile operators in the world. Sample Use Cases supported by Openet products:

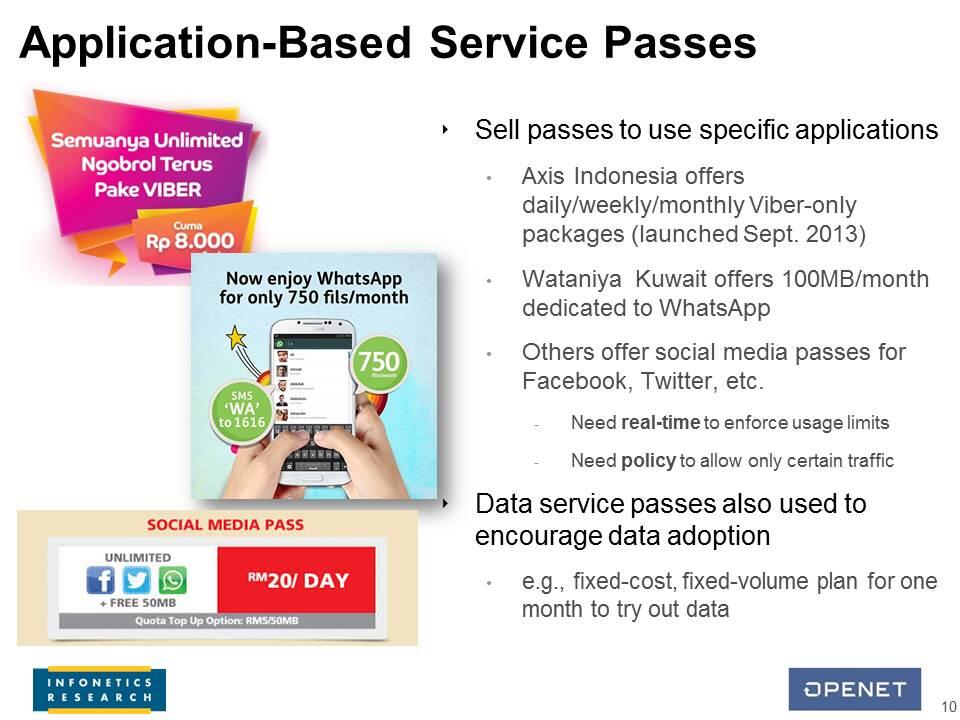

- Tiered data pricing (e.g. speed and quota)

- Usage notifications

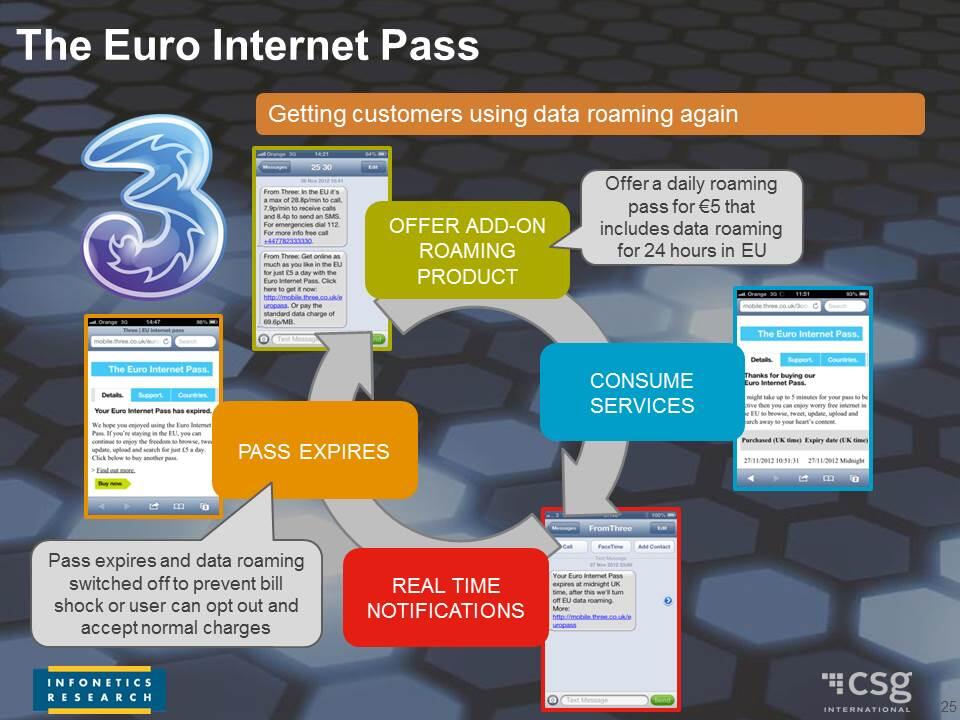

- Service passes

- Mediation for voice, U-verse, SMS and data services

- Pre-paid Data and Messaging Charging Control

- Roaming detection

- LTE Application Policy - Video Calling and VoLTE

.jpg)